In a recent interview with Mergers & Acquisitions, Eric Petersen of Abacus Finance said: “The private equity industry today is extremely competitive. There’s been a lot of capital raised, and a lot of funds, which is driving a very frothy market and making it very difficult for firms to differentiate themselves.”

One key differentiator that continues to drive success for private equity firms is investor credibility. This is perhaps the worst-kept secret of the industry: be a really good, authentic partner, and the deals will come. From where we sit, however, many firms could be much more strategic about their relationships, and have many more “at-bat” opportunities with key stakeholders if only they had the systems and processes in place to do so.

In this article, we explore a few ways that private equity firms can be more methodical about improving their reputation in the market by using technology.

Leverage data

No matter if you’re speaking to a contact with whom you’ve known for your entire career, or catching up with a contact you met a conference last year, it’s critically important that you stay in-the-know with their deal activity. It would be impossible to keep tabs on every investment bank’s moves, which is why the most effective private equity firms rely on outsourced data, in addition to their proprietary data. Companies like Sutton Place Strategies and Pitchbook provide best-class-class, clean data on all the latest deal activity in the market. These data points can also be seamlessly fused into your CRM system, making your day-to-day business development calling and email activity all-the-more productive.

Practice reciprocity

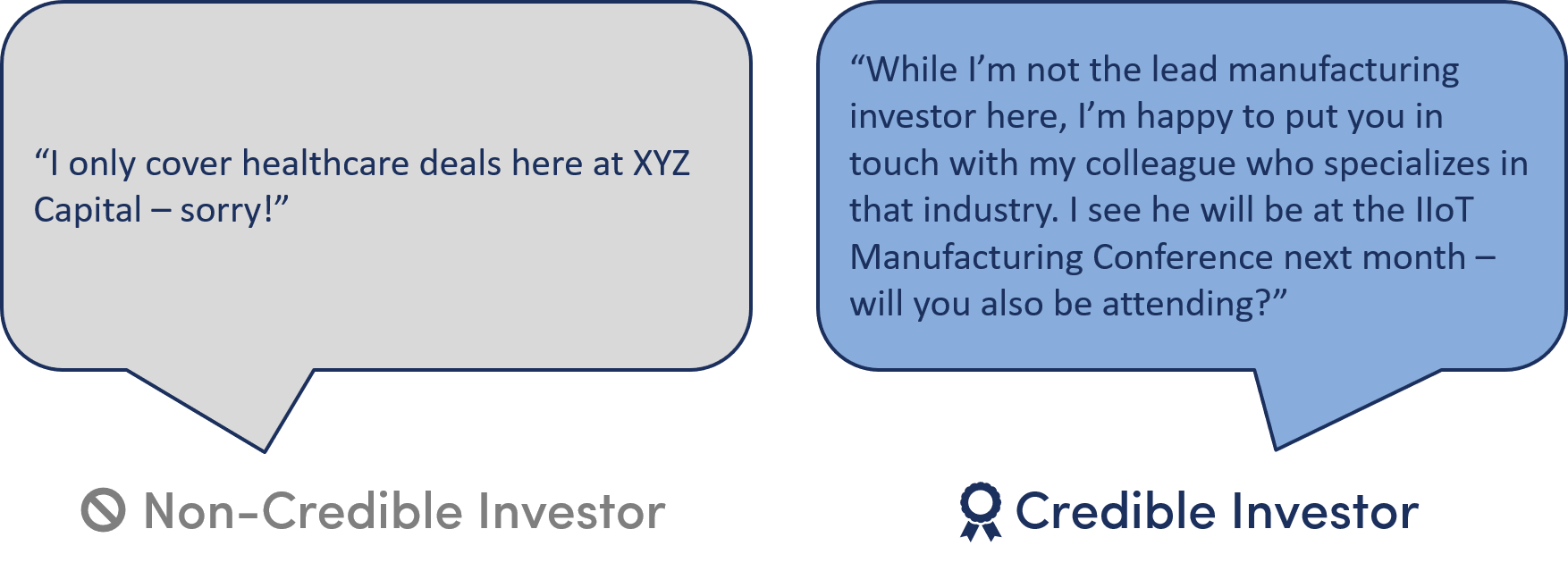

With the wide-ranging universe of transactions happening each year, it’s increasingly common that the majority of deals shown to an investor are not an ideal fit. While this remains a frustrating type of exchange between bankers and PE professionals, it doesn’t have to be quite so painful.

Instead of simply replying to a banker “no thanks,” it’s a best practice to point them in a better, more useful direction. This should be supported by the data that your firm tracks on industry participants and peers. The goal of practicing reciprocity is to give a banker something they can use, so that in the future, they will give you something you can use.

Some other examples a data-driven insights that are valuable to bankers include suggesting a industry-specific conference your team member is attending, or offering a introduction to a lender you have record of participating in that type of deal in the past.

Invest in processes

One sure-fire way to establish your firm’s credibility in the market is to make all of its internal processes more sophisticated. This can be particularly difficult for private equity firms with large business development teams who span geographies and have different strike zones.

Best-in-class private equity shops encourage ownership of every deal at every stage, and leave nothing up to question. Importantly, their technology increases transparency between team members that allows them to help one another access more deals.

Is your firm looking for more ways to establish your credibility to investors and be more methodical about your business development efforts? Get in touch with our team of specialists.