The way fund managers source deals and manage relationships has been forced to evolve as the deal landscape continues to change and competition increases. Intapp DealCloud’s fund manager software has the ability to cater and meet the unique needs of each firm while managing complex relationships and deal structures of the capital markets. In the past year, new trends have emerged in dealmaking that are shaping the way dealmakers are sourcing deals and managing relationships, which means a deal sourcing software is no longer just a nice-to-have, but an absolute necessity. Intapp DealCloud’s deal sourcing software enables fund managers to research potential deals, automate data collection, and generate reports and analytics.

Fund managers need the right data

To remain competitive in today’s deal making landscape, dealmakers have oriented their key deal sourcing activity around a combination of proprietary and third-party data. In response to increasing competition, fund managers are now tasked with streamlining operations and saving time wherever possible when sourcing deals.

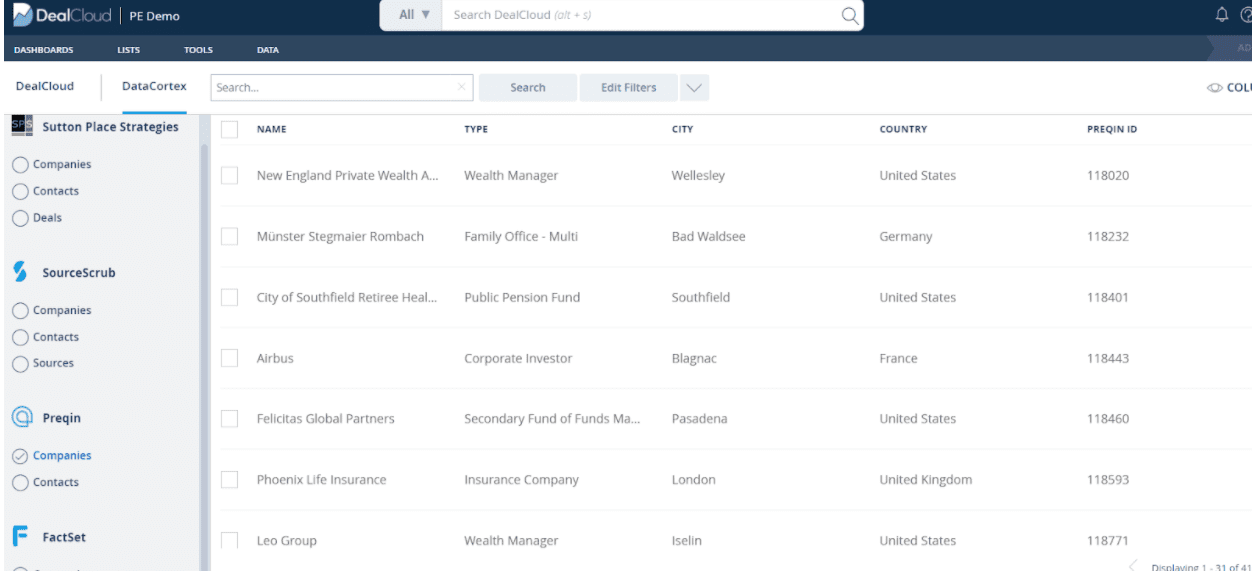

Access to private and public company data directly in the DealCloud’s deal sourcing software using DealCloud’s data management platform, DataCortex, has enabled firms to source and execute deals more effectively. Using data, fund managers can conduct comprehensive due diligence on companies and their funding rounds and finances. By having access to industry contact data, private and public company data, deals, news, and sources directly in DealCloud’s deal sourcing software, fund managers can devise investment strategies more efficiently by finding untapped opportunities across diverse verticals. This opportunity allows fund managers to act more quickly and confidently through modern data verification methods, data visualization strategies, and expert reporting and analysis.

DealCloud users can view private company data and contacts from top data providers through DataCortex.

Leveraging DataCortex allows fund managers to manage proprietary and third-party data within one unified view, and — more importantly — empowers capital markets firms to transform their data into institutional knowledge. DataCortex allows fund managers to search and query third-party data sets directly from within the DealCloud platform, eliminating the need to toggle back and forth between sites. Through DataCortex, DealCloud partners with some of the best capital markets data providers, including FactSet, Pitchbook, and Preqin and more.

Reporting and analytics tap into the power of data

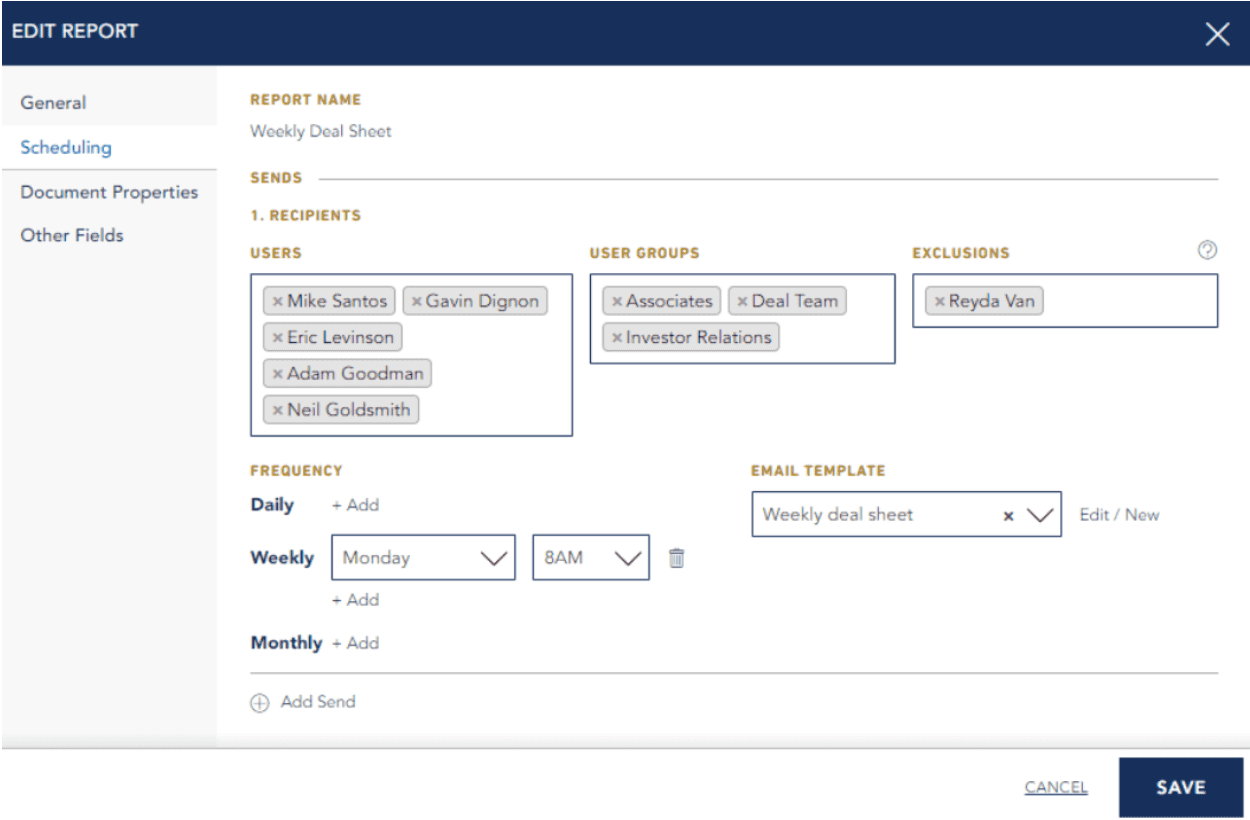

The reporting capabilities within DealCloud’s deal sourcing software allow fund managers to leverage their data in whatever way best suits their firm. Whether a deal team prefers a custom dashboard directly inside the platform, or delivered automatically by email, DealCloud’s deal sourcing software is easily configured to meet the needs of every fund manager. DealCloud’s software for fund managers unifies data, systems, and people with fully interactive reporting and every dashboard, chart, graph, tear sheet, data sheet, and profile can be customized to meet each user’s preferences when sourcing new deals.

DealCloud users can schedule pre-formatted reports to be sent straight to their inbox.

DealCloud’s software for fund managers enables teams to download and design preformatted reports based on any data set from either a web or mobile interface. Fund managers can also schedule reports to be sent to themselves, a team member, or group of people as a PDF or Word Document at a cadence that works best for them. In addition, most deal sourcing software does not offer portfolio view and reporting features such as quick and easy data segmentation, tear sheet downloads, and financial report downloads. However, all of these crucial elements for fund managers are available in DealCloud.

Deal sourcing software provides insights in landing higher quality deals

Fund managers who have chosen DealCloud’s deal sourcing software have been able to run laps around firms with industry-agnostic tools in the same way they’ve out-performed firms that have no technology at all. DealCloud’s fund manager software, along with the DataCortex solution, has enabled fund managers to act more quickly and confidently when sourcing new, high-quality deals. With thorough visibility into private capital markets data, reporting capabilities, and more, DealCloud’s deal sourcing software enables fund managers to save time and fuel efficiently when discovering new deals.