The secret is out: Environmental, social, and governance (ESG) performance can be directly related to revenue and costs. More and more advisory firms now require general partners (GPs) to provide ESG reporting and details on ESG strategies to limited partners (LPs) and regulatory institutions. These firms are also seeking opportunities to provide ESG services to clients in need of a plan and education on the topic. The question now is, how can firms and their clients successfully execute ESG strategies?

Without the proper technology infrastructure in place, ESG strategies can fall short of their goals. The need to collect, measure, and report on ESG is essential to a successful outcome for every stakeholder. This article will dive into how DealCloud enables capital market participants to drive successful ESG campaigns.

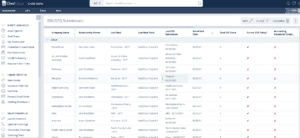

LPs and GPs are increasingly making ESG a focal point of their due diligence process. Unfortunately, data collected during due diligence is often siloed in Microsoft Excel spreadsheets, Microsoft Word documents, or Adobe Acrobat PDFs, and isn’t structured in a way that is insightful or actionable. DealCloud offers investors a way to collect, store, and report data from a variety of sources. Whether your ESG data comes directly from portfolio companies or GPs, is created internally, or is enriched by third-party data providers, DealCloud enables a comprehensive single source of truth for firm knowledge. Everybody across the firm can access the information and make smarter decisions with it.

Collecting ESG Data Directly from Portfolio Companies, General Partners, and Sellers

One of the most common ways to collect ESG data is directly from deal participants. This can prove challenging for people in a variety of roles, including private equity or credit investors making an investment into an operating company; LPs considering a stake in a fund manager; or real asset investors evaluating a property or infrastructure project. Firms, therefore, need a tool in place so that every party can seamlessly collect data directly from the opportunity participants.

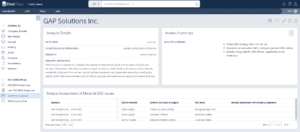

DealCloud’s integrated marketing solution, Dispatch, offers a webform submission tool called Pages, which clients can use to digitize ESG questionnaires (DDQs) to receive structured responses directly from deal participants. As data flows to you from questionnaire submissions, you can inform internal deal team members and incorporate the data directly into due diligence and investment committee discussions. You can also report back to LPs and external stakeholders.

DealCloud clients that leverage Dispatch Pages to create ESG DDQs are adopting industry standard questionnaires developed by organizations such as the Loan Syndication Trade Association (LSTA), Institutional Limited Partners Association (ILPA), Principles for Responsible Investment (PRI), and more. Clients can also incorporate their own propriety questions specific to the firm’s strategy.

Another benefit of leveraging a comprehensive deal management solution for ESG diligence is the historical database that accumulates over time. Users can clearly see where an opportunity stands from an ESG perspective by comparing it to past opportunities. If, for example, you’re evaluating a buyout investment into an operating company, you can compare how its ESG performance compares to current portfolio companies as well as passed or lost opportunities.

Creating ESG Data Internally

We’re witnessing a transformation in how the finance industry views the importance of ESG performance as part of due diligence and ongoing monitoring. This is especially evident in the ways financial service firms are hiring ESG-focused and trained professionals to help assess risk and develop strategies to improve ESG metrics. To attract and retain the best professionals for elevating your organization’s ESG strategy, a purpose-built technology must be in place to enable their success.

DealCloud provides an efficient solution for analysts, associates, and partners to track ESG assessments in a collaborative environment. Whether your firm is performing standardized, industry-specific ESG assessments — such as those from the Sustainability Accounting Standards Board (SASB) — or proprietarily developed ESG frameworks, DealCloud gives your professionals a platform to help automate, report, and share institutional ESG firm knowledge.

Enriching Your Deal Management Solution with Third-Party ESG Data

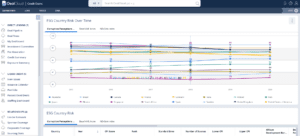

Firms no longer have an excuse to exclude ESG metrics from their evaluation and monitoring of investments due to readily available public and private third-party data. Subscription-based data providers such as Preqin, S&P Global, MSCI, and others have amassed an extensive database of ESG information for their clients’ use. Thanks to modern API technology, investors can augment their deal management platforms with the third-party data they subscribe to.

Investors also have the option to bulk-import data from other sources such as the Corruption Perceptions Index, Basel Anti-Money Laundering Index, ND-Gain Country Index, and other sources. Centralizing the data from these providers within your deal and pipeline management platform is key to ensuring it is visible pre- and post-investment.

To find out more about how DealCloud can ensure a successful ESG strategy for your firm, please request a demo.