More than 90% of limited partners (LPs) predict that the private markets will continue to outperform the public market. Many feel that private equity offers the best returns, and they’re hungry to invest in alternative assets.

With this demand, acquisitive firms presumably shouldn’t have trouble raising funds or generating returns. Unfortunately, competition for these LPs and their loyalty has increased along with the supply. To generate the best returns, general partners (GPs) must find and collaborate with ideal LPs for their funds.

A healthy and active investor pipeline frees you from inefficient fundraising so you can spend more time on high-value activities such as deal sourcing, execution, and portfolio company (portco) management. Learn how GPs can effectively improve their investor pipelines to better deliver results.

Fill Your Investor Pipeline with Profitable New LP Relationships

Don’t waste critical time on the wrong investors. Find or create the ideal LPs for your pipeline with a clear investment thesis and documented wins.

A strong investment thesis details more than just your target private companies; it also describes your ideal investor. Before your next roadshow, revisit your investment thesis to ensure it’s clear, concise, accurate, and reflects relevant internal or market changes. Include criteria for what you consider to be a suitable LP, such as:

- Minimum capital commitment

- Geography

- ESG philosophy

- History

- Hold period and time horizon expectations

- Preferred exit strategies

- Level of hands-on involvement the LP envisions having in portco management

You should also document your firm’s wins and create a repository of relevant information so new LPs can easily learn more about your firm. Ask your analysts to pull key statistics from investor reports regularly sent to your current LPs.

Once you’ve established your thesis and win documentation, your intermediaries can help introduce you to new LPs; alternatively, you can introduce yourself to experienced GPs from big firms who have joined or started their own co-managing firms. Journalists at Private equity Wire report that LPs are flocking to these new co-managers like never before.

Another way to find and meet new, profitable LPs with uncommitted capital is to look up similar portfolio companies and their recent exits to discover who invested in which deals. You can also create LPs by convincing venture capitalists (VCs) to switch to LPs. Ben Choi, a VC-turned-LP, revealed that if your investment thesis aligns with a VC’s goals and values, you should definitely pursue a GP and LP collaboration. The trick to landing these collaborations is creating a strong, positive relationship with the VC, then presenting your mutual goals in a compelling way.

“LPs are in the business of picking managers,” Choi told Kauffman Fellows. “If the managers don’t get along, for example, then there is a lot of lost energy that would otherwise be spent investing. An important part of the pitch is how and why you will stay together.”

Develop LPs to Refill Your Investor Pipeline

The success of your pipeline shouldn’t entirely depend on new LPs; you should also encourage repeat investors to commit capital to your fund. Since you already know how these companies operate and how much capital they have, you can facilitate smooth raises and executions while continuing to build on existing relationships.

Keep Your Current LPs More Informed

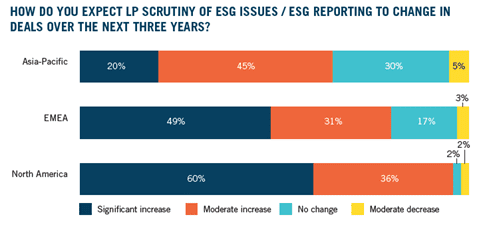

To encourage repeat commitments, it’s imperative to improve your investor reporting. LPs are increasingly interested in what’s going on at your firm and within portcos. Regarding environmental, social, and governmental (ESG) issues alone, 96% of North American GPs expect LP scrutiny to increase.

Source: Dechert’s 2022 Global Private equity Outlook

Get ahead of this anticipated increase by upgrading your reporting capabilities and processes.

Let Your Current LPs Play a More Active Role

When you involve investors in portco management, you’re not only providing them with a sense of ownership; you’re also building and strengthening your investor relationships, and subsequently paving the way for streamlined repeat raises. To improve portco cash flow or develop new products, involve LPs in your operational improvements by briefing them before and after management teams move.

Keep in mind that your investor relations team shouldn’t simply relay the observations and output of GPs to investors; your team should also send feedback from investors to the boards of both your GPs and portcos. EY’s Investor Relations Survey revealed that 77% of private equity firms regularly have investor relations (IR) representatives attend board meetings, usually to discuss market sentiment and investor activity.

Source: EY Investor Relations Survey

Report to your portcos’ boards about evolving investor behavior, sentiment, and values as a way of involving LPs in your company management.

Mine Your Investor Pipeline for Data to Move LPs Through Your Processes

Your firm’s investor pipeline contains mountains of data, most of which is typically untapped. Capture, extract, and use this data to spur relationships forward in your investor pipeline.

Use a Private equity–Specific CRM to Expose the Most Promising Investor Relationships

To help extract eye-opening insights, apply data to the value of relationships and the urgency with which each deal or partner needs coverage. These insights can help you keep relationships moving toward repeat closes.

To obtain key insights, you’ll need a CRM purpose-built for dealmakers and their needs. Every CRM can store details on investor contacts, but only DealCloud offers customizable scoring that factors in multiple elements to sort and elevate the most viable investor relationships. Relationship data you can rank and prioritize with DealCloud include:

- Investors’ Track Records — Score investor relationships automatically by whether they’ve invested with your team before. This is often a high-ranking factor for firms.

- Relationship Investment — Understand how much your team already invested into a relationship. If, for example, you’ve scheduled a management presentation for an investor, you can factor that in and weigh the importance of that factor when creating the relationship score.

- Curiosity Towards a Particular Fund — Evaluate investors’ engagement. If an investor has submitted an indication of interest (IOI), this could help increase the relationship score, depending on how much weight this factor carries within your firm.

DealCloud lets you score these aspects to automatically rank relationships, letting you focus on the relationships that show the most promise for both current deals and future raises. This keeps LPs moving through your process without the bottleneck of constant subjective assessments and discussions.

Use Relationship Intelligence Data to Focus Your Team’s Activities

Once you’ve prioritized your firm’s most viable relationships based on your firm’s values, you can determine how to best engage with the best investors.

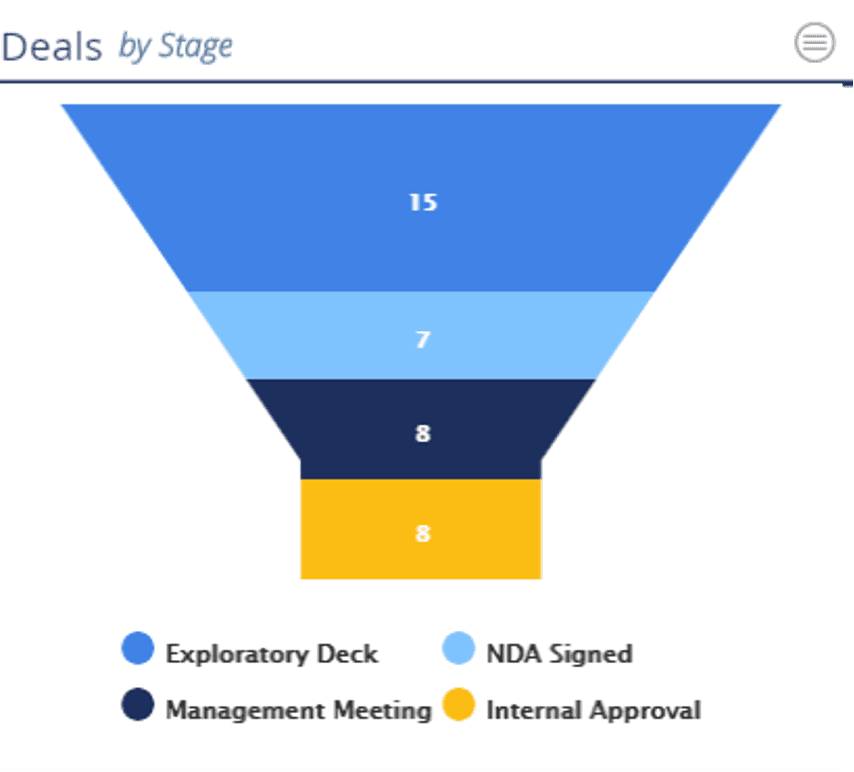

Source: DealCloud

DealCloud’s Relationship Intelligence solution can help you better engage with your firm’s network by providing the following insights:

- Connections — Learn who knows whom within firms. Even if, for example, an LP hasn’t invested in your fund before, that LP may have worked with one of your principals or attended school with an executive at your firm. Scoring this factor highly may prompt a catch-up call or email.

- Recency — Check how much time has passed since someone contacted a potential future investor, and consider setting a meeting.

- Impactful Activities — Determine which activities have historically prompted more movement. A contact, for example, may have committed capital to your fund after going out with your team for a meal; meanwhile, another investor may have decided to invest elsewhere after only receiving a few phone calls from someone at your firm. After recognizing this trend, you may decide to prioritize meals, outings, and face time to keep investors progressing through the pipeline.

Using a CRM built specifically for private equity dealmakers, your team can generate insights based on past relationship data to close more deals and raise more funds.

A Healthy Investor Pipeline is the Answer to Today’s LP Activity

Despite 2 years of pandemic-induced volatility, LPs want to invest now more than ever.

“During the global financial crisis (GFC) in 2008, many limited partners (LPs) pulled back from private asset classes and ended up missing out on much of the recovery,” explained McKinsey analysts. “This time, most LPs seem to have learned from history, as investor appetite for private equity appears relatively undiminished following the turbulence of the last year.”

To participate in the enthusiastic commitments of LPs, you must continually nurture your investor pipeline. Analyze your pipeline data to find ways to engage both new and familiar relationships for efficient, mutually profitable deals.

Ready to try a CRM that’s custom-built to help your firm improve its investor pipeline? Schedule a DealCloud demo.