“Relationships break much faster than they’re made, because it’s hard to gain trust and easy to lose it,” writes brand reputation and marketing expert Christopher Penn in a LinkedIn article. “If you screw up just once … you can permanently wreck the relationship.”

In financial services, credibility is the foundation upon which all professional relationships are built. One of the most prominent myths in the capital markets industry is that storytelling has the biggest impact on a fund manager’s credibility and relationships. However, after 14 years in the industry, we’ve determined that reciprocity — not a crafty narrative — is the real key to a group’s brand reputation management.

Read our top 7 tips for improving your firm’s brand reputation and learn how management technology can help.

1. Know and care about your partners’ current positions and goals

Build trust by showing institutional investors and acquisition targets that you’re committed to helping them reach their goals. Take time to research the moves they’ve made so far and learn everything you can about their work. By putting in this extra effort, your investors and potential partners will perceive you as an astute information manager.

Give your team access to third-party data providers that supply key information about your partners and targets. Set up Google alerts to receive a regular email digest of industry headlines that mention your partner or prospect, and follow limited partners (LPs) and intermediaries on social media. When they announce a new investment or event, congratulate them publicly by commenting and sharing it on social media.

By gaining a deep understanding of the past deals, positions, and goals of LPs, intermediaries, and targets, your team members can enter more meaningful conversations with them and — consequentially — build your reputation as a fund management group that cares.

2. Give team members firmwide visibility into your own group’s past work and current capabilities

Every team member needs access to key details about the deals your firm has taken on, including outcomes and the people involved. They also need instant visibility into one another’s bandwidth and capabilities so they can quickly clarify your brand’s direction and answer any questions LPs bring up. This readiness builds trust in your competence and connectedness as a group.

Private equity International’s 2021 LP Perspectives Study revealed that — by far — the number-one factor that affects LPs’ due diligence process when booking funds is a GP’s track record. LPs ranked this factor higher than a fund’s size, investment capacity, terms and fees, succession plan, balance sheet, and even ESG performance. Since LPs care so much about your previous work, every person on your team should know your group’s history inside and out.

However, accessing valuable information can be challenging for buy-side capital markets firms since most of it is trapped in individually managed spreadsheets or in the mental databases of partners, principals, and directors. If your team still operates by exchanging one detail at a time via a staff meeting, email, phone call, or text, then it’s time to upgrade.

Gain full visibility into the context surrounding each deal and relationship by adopting a firmwide information management system. Intapp DealCloud is purpose-built for the complexities of the transactions your firm handles every day. The software automatically captures, parses, and systematizes the information you need to build industry relationships and transact deals, and stores that information centrally for firmwide reachability and use. This accessibility gives context to your brand when team members contact outside parties.

3. Use data to decline misfit investors and deals quickly

Those who announce the most fruitful deals (including exit events) are the ones who are able to pass up ill-suited opportunities and outright duds the quickest. This requires decision-making at speeds that would have made acquisitive partners’ heads spin 20 years ago.

Why the new pressure? The democratization of information has empowered intermediaries and their fund managers who, until recently, had to spend hours researching and modeling. Instead of building on others’ work, they’d start from scratch because proprietary information wasn’t available.

Today, rather than starting research at square one, intermediaries have access to opportunities and financial information. However, this access has supercharged competitors’ sourcing and valuation work, resulting in a leadership pressure cooker.

To access real-time, comprehensive, hyper-relevant market information when you need it, turn to service providers like Preqin, FactSet, S&P Global, and PitchBook. Use DataCortex to sync these streams to your firmwide information system so that you won’t need to toggle between tabs and tools.

Once you have access to this market information, you can quickly make decisions about which deals to take and which ones to dismiss. Avoid stringing people along if you know it’s not going anywhere. Instead, log the relationship and set reminders to regularly help those contacts in any way you can.

4. Don’t be the reason deals fail

A tried-and-true way to build your brand’s reputation in the private capital markets is to do better work than other fund managers. This includes adopting best practices to ensure your deals don’t fall through.

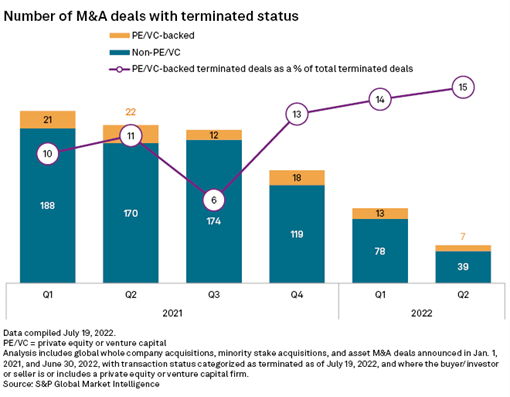

S&P Global analysts recently reported that the percentage of announced deals being scrapped has skyrocketed. Although hung deals are occasionally unavoidable, most are preventable.

Learn the most common reasons deals falter and put procedures in place to avoid those hazards.

- Confirmation bias — A culture of internal competition works against a deep understanding of a deal’s full profile. Holding internal discussions on confirmation bias is an effective way to neutralize the risk.

- Incomplete due diligence — Analysts must work quickly to advance ahead of rival sponsors. However, they must also take the time to collect information after initial due diligence; otherwise, the firm is more likely to uncover problems later in the transaction.

- Ineffective negotiations — You must ensure that both the client and your firm are content with the proposed engagement terms. One acquisitive team brought in an FBI hostage negotiator to learn how to create win-win situations through productive deliberations.

- Unfamiliar and unpredictable human behavior — Although this issue is difficult to sidestep, you should still try to learn as much as you can about every dealmaker involved in each transaction so you can predict their next moves. This can not only help mitigate risk, but it can also give you conversation fodder.

- Manual administrative work — Automation technology used to be a nice-to-have, but now it’s table stakes. When firms leverage technology to complete administrative work faster, deals are less likely fall through when a more agile competitor contacts your LPs, intermediaries, or acquisition targets.

5. Get ahead of bad press

Public relations (PR) can be defined as earned media: When your group is mentioned in an outlet that you don’t own, it’s because that outlet feels you’ve earned the attention of its audience.

If a capital markets commentator mentions your buy-side firm favorably, you can capitalize on that exposure without doing the work of building the audience from scratch yourself. It’s a great opportunity to promote your brand and potentially gain new business.

However, if your firm is getting unwanted press coverage for a mistake or a bad move, you’ll need to protect your brand reputation by getting ahead of the negative PR as quickly as possible.

- Foster an internal culture that values openness and safety — Brand reputation management begins long before news leaks. Talk often about owning missteps; then, when someone makes a wrong turn, partners can discuss a response plan before it’s needed.

- Issue an apology when necessary — Acknowledging and owning a mistake is the first step to moving forward.

- Distribute talking points to team members — Help prepare your team members for conversations by clarifying where you stand on a variety of issues. This way, they’ll feel more confident when answering questions from the press, your clients, and other outside parties.

- Set measurable goals for improvement in your weakest areas — People are more understanding if you can prove you’re working on your admitted shortcomings.

- Amplify your wins — Publish your proudest achievements in every area, especially areas where other firms fall short.

6. Stay in touch with all contacts and maintain old relationships

In the private capital markets, old relationships are the best source of new relational and brand equity. It takes less time, energy, and money to maintain and revive previous relationships than it does to create new ones. Your seasoned relationships with LPs, consultants, advisors, intermediaries, and acquisition targets come with a foundation of trust, which is the basis for all good brand reputation management.

Never let people feel used and neglected by disappearing or discarding friendships once deals are dismissed or completed. When you meet people who can’t help you right away, keep their contact information. When you dismiss a deal because it’s not a good fit, pass it along to a sponsor house that may appreciate the tip, then follow up in a couple of months to ask how the transaction is going.

“Companies will come and go, employees may come and go, but the people in the private equity industry tend to be fairly stagnant,” advises Adam Coffey in The Private equity Playbook. “You keep crossing paths with people, so it’s imperative to treat them well and with integrity.”

To keep older professional friendships alive, configure your CRM to alert you periodically to reach out and warm up old contacts with a relevant industry headline or recommendation.

7. Be more organized and reliable with sensitive information

On average, data breaches cost the capital markets $13.9 million annually. Breaches also cause reputational damage to your firm, which in turn lead to even more losses. After all, what client wants to enter such high-stakes transactions with an unreliable data steward?

The good news is that if you handle data more carefully than anyone else, you can avoid this financial and reputational cost.

The best way to do this is to do away with the unsanctioned, “rogue” tools that your team members use to do their jobs. Replace them with a firmwide information security system that achieves all the same (if not more) outcomes for them. You can then build relationships knowing they won’t be compromised when hackers poke around your firm’s systems and processes.

For private capital brand reputation management, build deeper relationships

In the private capital markets, you can’t occasionally blast a positive message and expect the tactic to produce credibility. As Joan Miller, former Chief Marketing Officer of Summit Partners, told BackBay Communications analysts, “A brand is the accumulation of experiences that people have with you over time. It is so much more than a logo or an ad campaign.”

As you build deeper relationships, you’ll reinforce your reputation as a firm that prioritizes its clients, and will gain mindshare in the industry.

Better manage your firm and your reputation by using an integrated pipeline, relationship, and deal management system like Intapp DealCloud. Schedule a demo.