Intapp DealCloud

Discover, win, and execute new business with unified deal and relationship management

Capture, unify, and apply the collective intelligence that flows through your firm with one complete deal and relationship management platform.

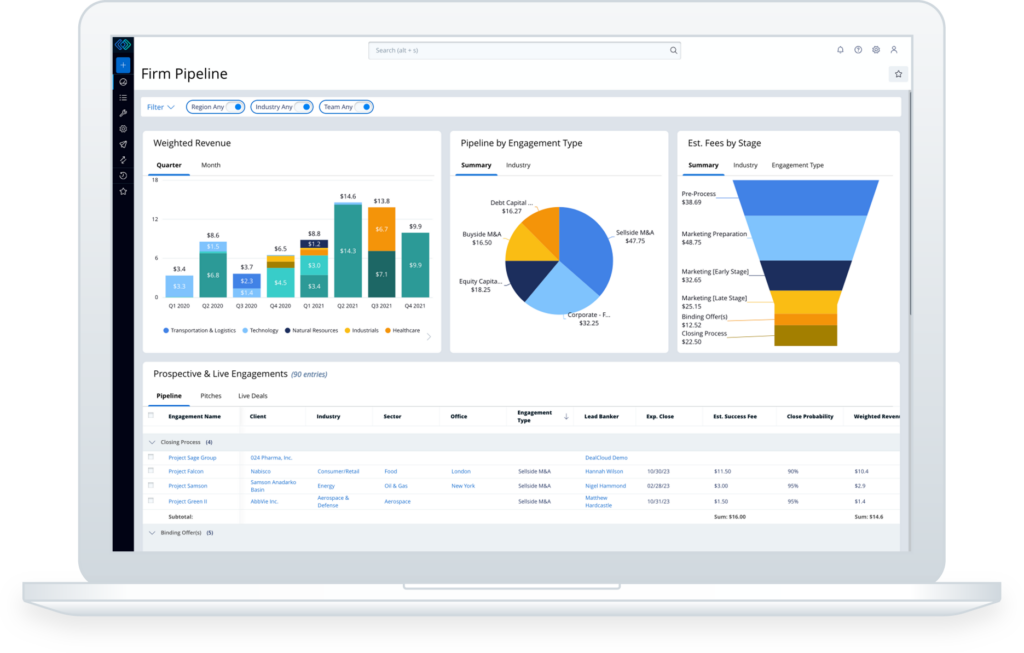

So much more than a CRM, Intapp DealCloud provides a single source of truth to help teams strengthen relationships, accurately track and forecast pipeline, and accelerate execution. AI-powered and purpose-built, DealCloud enables better performance for stronger growth.

Empower firm growth with Intapp DealCloud

Centralize firmwide intelligence and transform it into the insights your firm and professionals need to succeed.

Source more opportunities

Discover and nurture network connections to identify quality opportunities and build pipeline with unified firm and market insights.

Boost productivity

Multiply the effect of your professionals and eliminate frustration with the help of automated workflows and Applied AI.

Fuel firm growth

Give your team the tools they need to execute and win more business, faster.

Become more efficient and more focused

DealCloud has allowed us to manage our significant pipeline in a more sophisticated way, and using DealCloud, we are more efficient and focused.

Not only does my team know everything happening on every single deal at the click of a button, but we also provide valuable visibility into our deal activity to our CEO and board.

Intapp DealCloud unifies your entire deal lifecycle — from strategy and origination through execution

Deal execution and collaboration

Centralize deal execution workflows and team to-dos in an efficiently managed information hub.

Firm knowledge and strategy

Accelerate communication sharing and improve decision-making with a single source of truth and analytics.

Leading firms trust Intapp DealCloud

Intapp DealCloud

Improve deal and relationship workflows for your firm.

Real-time institutional knowledge sharing

Improve communication and inform decision-making with unified workflows and intelligence.

Industry tailored blueprints

Unlock industry best practices with strategically designed site structures, reports, and workflows based on years of use case experience.

Frequently asked questions about Intapp DealCloud

-

Growing your firm requires effective management of your relationships, knowledge and intellectual capital. But traditional and legacy systems aren’t built to adapt to the current and complex needs of professionals. And using multiple systems often leads to problems like duplicated effort, inconsistent data, and frustrated users.

With DealCloud, your professionals can access one central hub that provides full visibility to every aspect of your dealmaking and pipeline. Which means your firm gets a single source of truth for your data, robust workflows built to capture the entire network of relationships involved in closing a deal, a hub for simplified collaboration, and AI-powered insights for better decision-making.

-

With Intapp DealCloud, your professionals can track a wide range of relationships and activities — including contact, deal, and process data — so your firm can easily access and apply its collective intelligence. Integrated workflows, valuable relationship intelligence, and configurable reports provide real-time insights so your teams can make better, faster decisions.

-

Your firm can configure its DealCloud instance to meet your specific requirements and processes. DealCloud’s workflows, reports, permissions, and data structures are flexible and easily configured to meet your teams’ evolving needs. You can connect the software with your firm’s existing systems, including HR, accounting, and more.

Schedule a demo of Intapp DealCloud

Speak with an expert

Fill out the form and someone will be in touch to schedule a demo.

Intapp Intelligent Cloud

For more than a decade, Intapp has been bringing the power of automation and intelligence to professional and financial services firms — helping clients like you solve their specialized needs and challenges.

Intapp Cloud Infrastructure

Use AI confidently, knowing we keep your data secure through our partnership with Microsoft and our own commitment to security and compliance.

Learn more about our cloud infrastructureIntapp Data Architecture

Quality data is at the heart of good AI — and with Intapp, you benefit from our data architecture.

Learn more about our data architectureIntapp Applied AI

Our Applied AI strategy includes five essential AI capabilities that help you make smarter decisions, faster.

Learn more about our Applied AI strategy