Hedge funds software

Generate higher returns with

one source of truth for your deals

Expand your network, close more deals, and generate higher returns with one source of truth for deal and relationship management.

With detailed intelligence and insights, Intapp DealCloud for hedge funds helps you stay ahead of competitors, better analyze your network possibilities, and operate more efficiently.

Fast-track deal progression with Intapp DealCloud for hedge funds

Get the insights required to accelerate deals from strategy through execution.

Close deals faster

Expedite dealmaking by organizing, normalizing, and centralizing insights.

Strengthen relationships

Nurture meaningful connections with AI-driven relationship intelligence.

Source more business

Discover new opportunities by tracking emerging market trends and developments.

Get a natural fit to manage

capital-raising efforts

We are service managers who offer more niche-type strategies than your typical direct lending institutions … our platforms must be equally robust. Choosing [Intapp] DealCloud to digitally manage our capital-raising efforts and institutional investor relationships was a natural fit.

Create stronger connections with the platform built for hedge funds

Enhance relationship management

Strengthen relationships with AI-driven intelligence reporting, automated data capture, and centralized coverage.

Simplify email marketing

Simplify investor outreach by designing, sending, and analyzing branded email campaigns.

Accelerate business development

Discover new opportunities by monitoring sponsor and intermediary relationships alongside market activity.

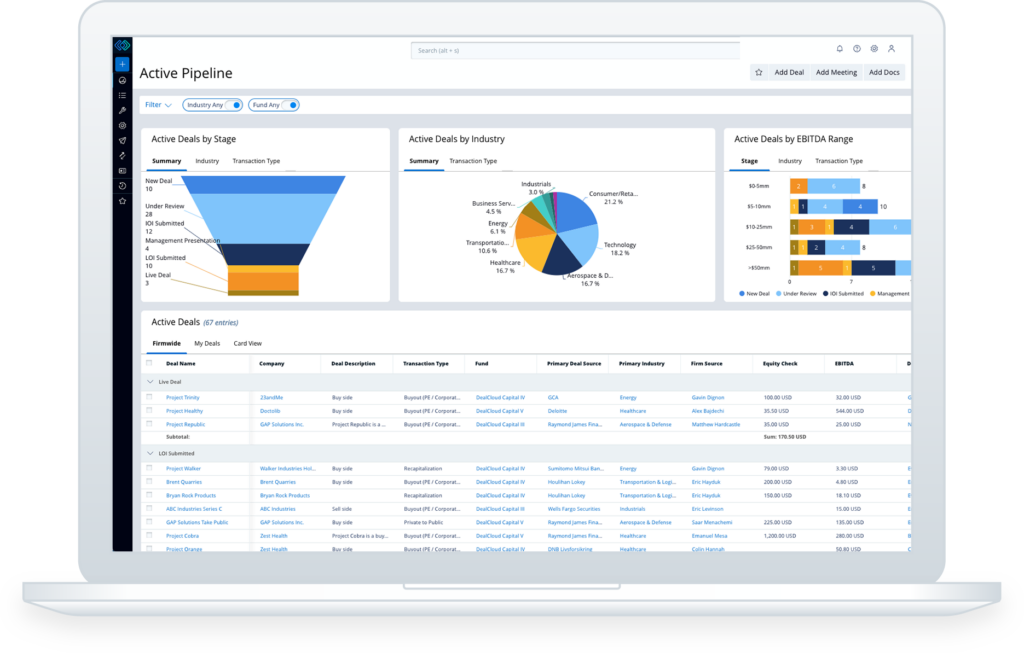

Improve pipeline management

Achieve better outcomes by centralizing target pipeline and maximizing resource allocation.

Fast-track deal execution

Accelerate deals by centralizing due diligence checklists and approval workflows in one information hub.

Streamline investor relations

Make investor outreach, lead progression, and fundraising more efficient by synthesizing complex firm data.

Improve decision-making

Make more informed decisions by centralizing institutional knowledge in one platform.

Leading hedge funds rely on Intapp DealCloud for deal and relationship management

Transform investing with centralized deal and relationship management

Real-time institutional knowledge sharing

Improve communication and inform decision-making with unified workflows and intelligence.

Automated workflows, alerts, and reports

Stay current with deal to-dos with automated task workflows, notifications, and AI-generated signals.

Configurable reporting and analytics

View firmwide pipeline and inform deal execution with reports, tearsheets, and other customizable resources.

AI summaries and recommendations

Save time with AI-driven deal summaries, and make better decisions using AI recommendations based on firm and market intelligence.

Extensive system integrations

Share data across your firm with a central hub that integrates with Microsoft 365 and other applications your team uses every day.

Actionable data

Inform and empower your dealmakers by transforming your proprietary and third-party data into institutional knowledge.

Frequently asked questions about Intapp DealCloud for hedge funds

-

To stay relevant in a highly competitive market, your hedge fund needs to track emerging trends and maintain visibility into rapid developments within key industries. Intapp DealCloud is built to provide you with the data and insights needed to be first to market and win more business.

Detailed relationship insights that visualize complex data sets help you and your staff better leverage strong connections in both individual and collective networks. These insights are crucial for staying ahead of the competition, especially if your hedge fund has complex, differentiated needs.

With one platform for organizing, normalizing, and centralizing information, hedge fund managers can spend less time searching across disparate data sets and more time in data analysis and decision-making. AI-powered functionality also enables investors to quickly complete administrative, time-intensive tasks — giving them more time to nurture relationships that lead to closed deals.

Whether your firm has just closed its first fund or completed hundreds of transactions, Intapp DealCloud for hedge funds will help your firm grow and operate more efficiently.

-

Intapp DealCloud lets users track a wide variety of deal data including sourcing, progress, and staffing details — helping you manage deals throughout the entire lifecycle. Integrated workflows, pipeline analytics, and configurable reports provide real-time deal insights so your team can make informed decisions.

Information is presented on intuitive, configurable dashboards that provide value for limited partners while helping hedge fund managers more easily find market-leading advantages and competitive insights.

-

Yes — Intapp DealCloud for hedge funds can be customized to meet your firm’s specific requirements. The platform was built by industry experts who understand that not all hedge funds operate the same way, so the solution is designed to accommodate varying pipeline, relationship management, and reporting requirements. It can be configured to support the unique needs of individual users, teams, and divisions. Team members can customize every dashboard, chart, graph, tearsheet, data sheet, and profile to meet their preferences and interests. Access levels may be provisioned on a user-by-user basis.

Schedule a demo

Speak with a private capital industry expert

Fill out the form and someone will be in touch to provide a demo.

Intapp Intelligent Cloud

For more than a decade, Intapp has been bringing the power of automation and intelligence to professional and financial services firms — helping clients like you solve their specialized needs and challenges.

Intapp Cloud Infrastructure

Use AI confidently, knowing we keep your data secure through our partnership with Microsoft and our own commitment to security and compliance.

Learn more about our cloud infrastructureIntapp Data Architecture

Quality data is at the heart of good AI — and with Intapp, you benefit from our data architecture.

Learn more about our data architectureIntapp Applied AI

Our Applied AI strategy includes five essential AI capabilities that help you make smarter decisions, faster.

Learn more about our Applied AI strategy